By Ryan Reed

Electricity-generating solar cells, or photovoltaics, are everywhere these days, powering highway signs and call boxes, pocket calculators, and most of those satellites circling overhead.

While PVs have proven their mettle in isolated situations off the utility electrical grid, their use in generating power for consumers with grid access is still rare. Solar power may become to the 21st century what oil was to the last, as some experts claim, but at present PVs account for far less than 1 percent of the nation’s energy needs. [In 2023, PV contributes more than 3% of US energy needs. — Editor]

Yet a critical stage for photovoltaics has clearly arrived. It may be decades before solar can compete head-to-head with oil, but political and market pressures building over the past few years are making PVs an economically viable option in many locations. It’s an opportunity not just for solar designers and installers, but for design professionals, builders, and roofers as well.

PVs are going into grid-connected schools, public facilities, commercial buildings, and both luxury and modest homes – buildings whose owners can afford the up-front cost and can accept a long-term return on investment.

PVs can be made into window glazing, mounted on walls or awnings, but their most popular structural location is the rooftop. With appropriate mounting brackets and sealant, modules can go over any roof material. But many architects, solar designers, and installers are finding that standing seam metal is, for practical reasons, the best material support for their rooftop installations. There are even PV products designed specifically for standing seam panels.

As a recyclable and long-lasting material with proven thermal performance, metal has long appealed to those in the green building movement. But its primary appeal is to those who appreciate long-term life-cycle costing, and who are willing to put up with a higher up-front cost. Sound familiar? The same customers, whether residential or commercial, who are inclined to metal roofing are also candidates for PV installations.

According to the National Renewable Energy Laboratory, the cost of photovoltaic power per watt has dropped 87 percent since 1980. The lower price helps, but the biggest change has come from political and public pressures that have led to an array of state and local incentives, buy-down programs, and subsidies that can cut the initial cost of a system in half.

The incentives aren’t just a function of environmental idealism. Utilities in some areas are desperate to shave their peak energy demand – usually reached in the hottest part of summer, just when PVs are producing the most output. Even modest numbers of PVs hooked to the grid can make the difference between needing a new power station or not. Utilities across the country have mounted programs to buy “green” power at premium rates, and even to install PV systems to “donor” rooftops.

“Utilities are pushing solar with the immediate goal of not having to put in more coal and nuclear plants,” says BP Solar’s Jerry Paner, who has been promoting commercial PV projects large enough to affect such decisions.

Many states and localities, whether for political or practical reasons, have instituted buy-down programs and other incentives to encourage PV installations. Some of these pay for more than half the up-front cost. Grid-connected systems benefit from net metering, initiated by utilities over the past decade, which allows consumers to feed excess power back into the grid for credit. At the same time, doubts about the grid have led others to set up PV systems with batteries that give them both a back-up power source in case of a blackout and power not subject to the kind of wildly fluctuating prices suffered in Western states two years ago.

Photo Courtesy of Uni-Solar

Both public agencies and commercial owners are often under pressure to design buildings with LEED ratings, a system developed by the US Green Building Council. Points are awarded to a building for its environmental impact. Supplying 5 percent or more of a building’s needs with an alternative energy source such as solar is one way to rack up the LEED points.

Finally, the environmental benefits of solar power appeal to an increasing proportion of the American public, including homeowners. Consumers investigating PV systems using web-based calculators can get both cost calculations and the tons of greenhouse gas emissions a given system will keep out of the atmosphere.

Public attitudes about the environment present another angle for commercial clients. Many companies, whether wineries or oil corporations, are finding benefit in projecting a “green” image. Photovoltaics are perhaps the flashiest way to demonstrate a commitment to the environment: let’s face it, a solar-powered gas station makes for better public relations than installing more insulation or energy-saving light fixtures, even if the power savings are the same.

Up On The Roof

Until recently, the high cost of PVs has dictated that they be used at utmost efficiency: south-facing, tilted at 20-30 degrees (depending on the latitude), and adjusted seasonally. This made field arrays, often fitted with tracking devices, the preferred way of mounting the modules. But with lower cost, losing a few percentage points in efficiency doesn’t loom as large. Most roofs that are either flat or basically south-facing are now candidates for solar installations. Unlike field arrays, rooftop PVs don’t take up real estate, they’re relatively secure from vandalism or damage, and don’t block any views. Rooftop mounting can help lower overall system costs.

But putting PVs on rooftops brings up both aesthetic and practical issues. Photovoltaic systems are generally warranted for 20 to 25 years, and may well last twice that long; rooftops are often covered with materials that need replacing much sooner. Removing modules to reroof isn’t difficult, but it certainly adds to the costs of reroofing and the potential for damage.

The material works as well on structural panels (on awnings at the Mendoza Elementary School, Imperial Beach, California. Photo Courtesy of George Kottchroma.

More importantly, modules installed on racks over most materials require penetrations to tie them into the framing. This means careful detailing, additional maintenance, and a greater likelihood of leaks. “Beyond the first cost, the idea of roof penetrations is a non-starter for a lot of architects,” notes Paner.

Aesthetic issues also come up. The standard method of mounting PVs on pitched roofs has been to build large metal or wood frames, bolted to the roof, that float above or sit on the roofing material. In some cases, frames have been inset into the roofing material, but at additional expense.

In either case, the geometric grid of PVs presents a sharp contrast to the textured, organic aesthetic of shakes, tile, or shingles. Over the years, PV manufacturers have tried to make modules that look like traditional roofing materials to minimize the aesthetic clash. There are now several PV materials that mimic asphalt shingles, slate, or flat tiles. But the stylistic range is limited, and the shinier PV surface never really blends in with the organic materials. The products tend to be more expensive than modules as well, and sometimes require considerable wiring in the attic space below.

Metal Roofing & PVs

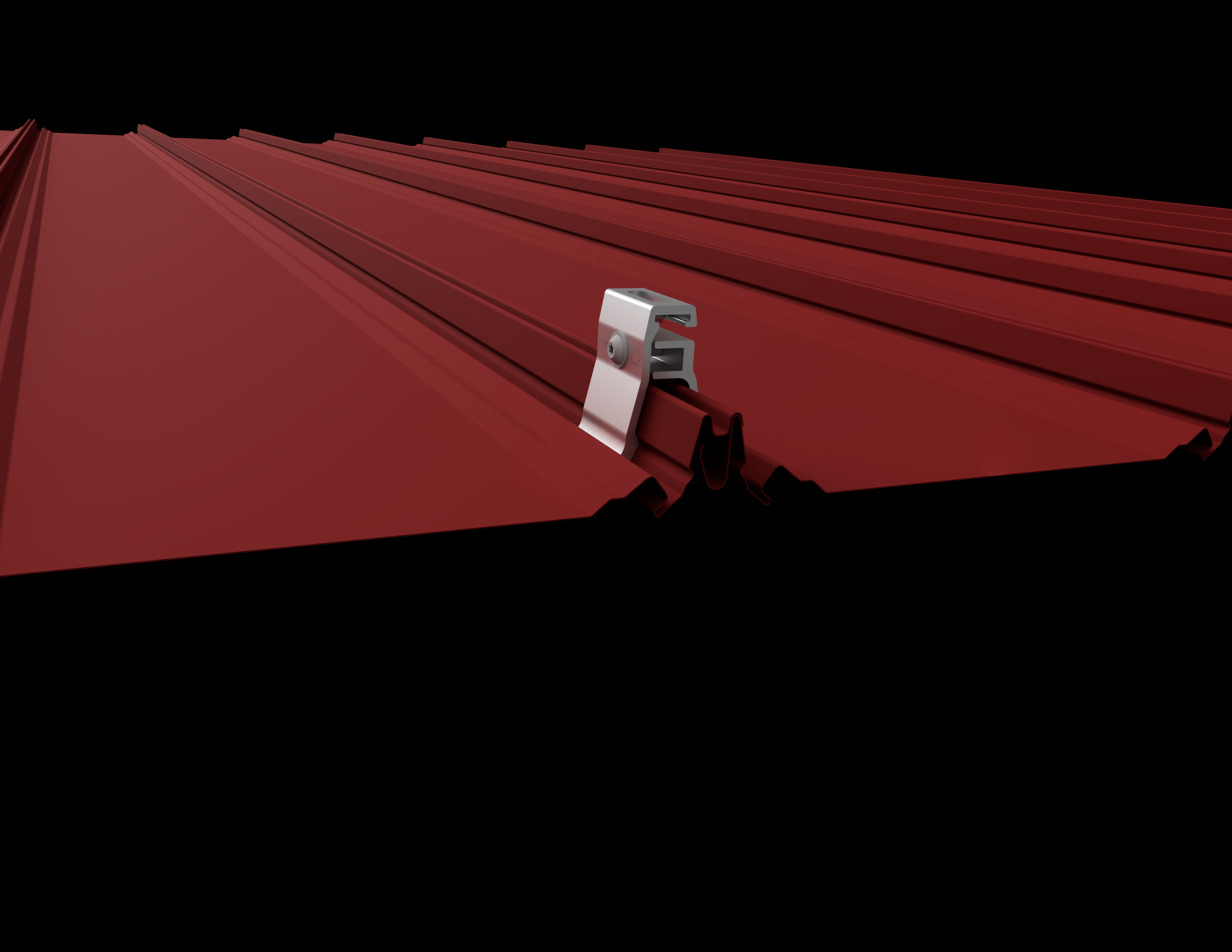

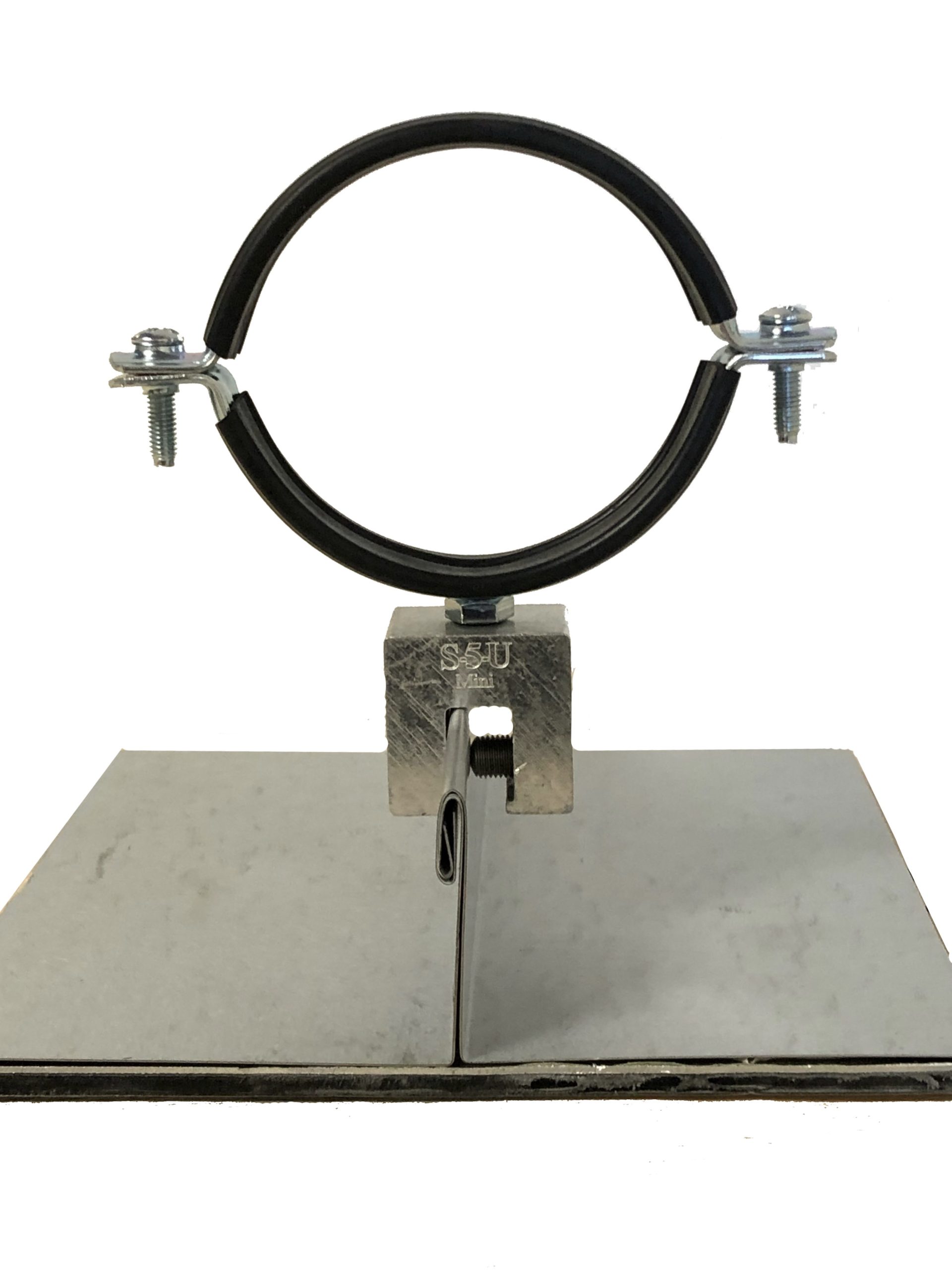

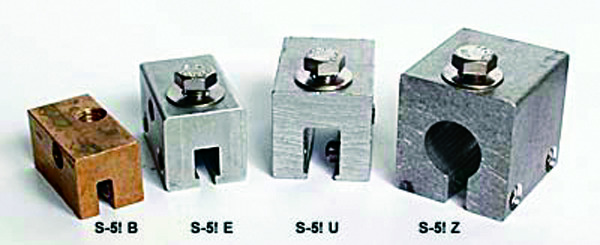

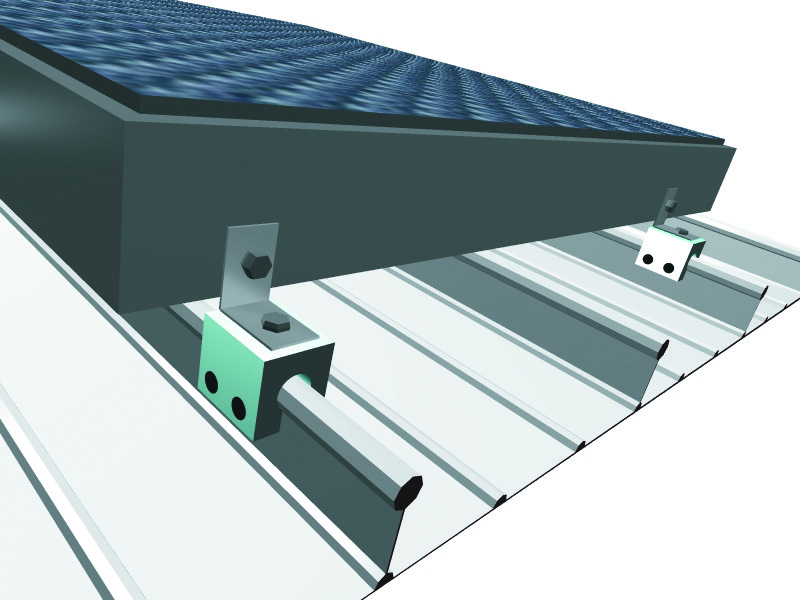

There are a number of practical and aesthetic issues that make standing seam metal the ideal rooftop for mounting PVs. Racks of modules can be clamped firmly to the seams without creating penetrations. With an engineered product such as Metal Roof Innovations’ S-5!, designed for snow fences and other roof attachments, the connection can meet specific wind uplift and load ratings.

“Metal is simply the best substrate for photovoltaic installations,” says Paner. Installers have used various arrangements of hat channel to mount racks on metal, but direct clamping is also possible. Making the connection with a rated clamp designed for the specific metal profile, he says, helps solve liability issues that can arise on large projects.

The markets for metal roofing and PVs clearly overlap, says Paner. Most PV customers plan to own their buildings for a long time. That’s why public agencies, schools and universities, the military, and well-heeled corporations are ideal. And that’s the same criteria for clients who benefit most from premium metal roofs.

Standing seam roofing also smooths the aesthetic clash of PVs with traditional roofing materials. The geometric patterns of PVs simply look more at home on the vertical seams of metal than bolted over tile or shake.

PVs and Metal – The BIPV Option

There are two basic kinds of PV modules, monocrystalline and polycrystalline, and they are made by dozens of companies worldwide. They vary by price and efficiency, but both types require a metal frame with a plate glass covering. But there’s another kind of photovoltaic material developed in recent years — and it’s even more preferential to metal. Triple junction thin-film amorphous silicon photovoltaics, a proprietary technology of Michigan-based Uni-Solar, use layers of silicon deposited on a thin sheet of stainless steel to create a flexible membrane. The resulting product is far less efficient than crystal modules, and requires greater area to produce the same wattage, but is less expensive to manufacture.

Uni-Solar has used the lightweight, flexible material to make products such as roll-out battery rechargers. They’ve also formed it into roofing materials, including shingle-style sheets and tiles. It hopes eventually to make the material into an independent, TPO-style roofing material.

But its most practical current rooftop use is simply laminated to a standing seam metal roofing panel. Created in widths to fit neatly into a 16-in. metal pan, the material can be installed by a roofer and wired through the ridgecap, with no penetrations for mounting or wiring.

Uni-Solar first bought metal panels and factory-bonded the PV material to them. This meant limited panel lengths, long waits, and high freight costs. The company then developed a peel-and-stick adhesive backing for the material. This allowed panels to be delivered to or fabricated on site, field-laminated with the PV material by company-trained installers, then installed on the roof, as the roof, by a roofing contractor.

Some installers found that the material slid down slope on hot days; the company began recommending fastening the material to the pan at the top edge with a few screws under the ridgecap. The slippage raised questions about the material’s long-term adhesion. Although Uni-Solar has stuck by its 20-year adhesion warranty, it is planning to switch to a different adhesive, currently undergoing testing.

Adhered to a roofing pan, the material now becomes what is known as a building-integrated PV, or BIPV, as opposed to a building-applied PV such as the modules. BIPVs are part of the building envelope itself, and include thin-film (translucent) PV window and skylight glazing, modules used as awnings, and PVs made into roofing materials such as shingles or tiles.

Since BIPVs are part of the building membrane, the PV is doing double-duty as part of the building — in theory allowing for cost savings in the total assembly. In the case of the membrane adhered to a metal roof, the laminate eliminates the need for racks, clamps, and a lot of the rooftop wiring.

The other advantage of BIPVs is aesthetic. The laminate isn’t invisible (unless the metal roofing is very dark blue), but it arguably blends into different architectural aesthetic with ease. As an essentially untextured, glossy patch of color, it is well suited to vertical seam metal.

Setting the PV laminate against crystalline modules makes for an apples-to-oranges comparison. The modules are much more efficient, and so require less space per watt; the laminate is less expensive, though not necessarily cheaper per rated watt. Crystal panels have been tested against hail up to 1-in., but the glass is still breakable; the flexible laminate won’t shatter, but the system can still be damaged by large enough objects. The triple-junction laminate performs well in low-light situations and even partial shade, and also retains efficiency at high temperatures; crystal modules lose efficiency in other situations.

On sloped roofs, especially residences, the sleek look of the laminate may be more suitable than clamped-on modules, and the impact of the dark material on the metal roof is minimized over a vented attic. And no glass means no complaints about glare.

But in fact both styles of PVs have been used in either situation, usually for reasons specific to that installation. Some smaller roofs, for instance, may need the higher efficiency of crystalline modules to achieve a desired kilowatt output.

On the other hand, some low-slope roofs may need the qualities of the laminate. At San Francisco International Airport, solar designer Tibor Fischl of Occidental, Calif.-based Renewable Energy Resources used the laminate on metal panels that were then mounted, module-style, on a built-up roof. “The airport was concerned about the reflection off glass modules disturbing pilots,” says Fischl. The material’s performance in low-light situations also seemed appropriate for the often fog-bound locale.

It’s tempting to view the two types of PVs as ideal suited to different applications. On lower-sloped buildings, modules won’t prompt the aesthetic concerns they can on some pitched roofs. With no attic space to dissipate heat gain, shade-creating panels can boost the building’s thermal performance in cooling climates.

Fischl also used laminate on metal panels mounted on a flat roof for a custom home across the Bay in Oakland. The concern was primarily aesthetics and reducing glare for the hillside dwellers above the home. Fischl created what he calls a “piano” layout of standing seam metal panels across the multiple surfaces of the flat roof, resulting in a unique hybrid roof of metal and ballasted membrane.

Some module panels are finding their way onto metal roofs through a product designed specifically for flat roofs. Powerlight Solar Electric Systems, based in Berkeley, Calif., buys crystalline PVs from a variety of sources, then laminates them onto modular insulation boards. These squares interlock along their slotted edges, and can be placed on flat membrane roofs and held down with ballast or edge fasteners.

The system was also used successfully on an industrial metal building topped with a ribbed panel. When the Hayward Lumber Company began planning a new truss manufacturing plant in Santa Maria, Calif., it decided to build a LEED-rated plant powered entirely by PVs. The architect specified 14,000 sq. ft. of Powerlight’s insulated PowerGuard PVs to go over the building’s R-panel roof in order to cut the cost of insulation, since the PVs would insulate the roof from above. A special perimeter mounting system (with penetrations sealed with butyl tape) was developed to tie the panels to the purlins.

Whose Business is This, Anyway?

Few in the metal roofing industry have shown much excitement over photovoltaics, or metal’s fine prospects in that market, and it’s easy to see why: the volume is still miniscule. If it’s just a matter of metal companies supplying someone else with material, there isn’t much to even talk about.

But there are some who have visions of marketing metal roofing and PVs together. Paula Grider, a sales rep for McElroy Metal in Southern California, has been including an introduction to building-integrated PVs in the regular metal roofing seminars she gives for architects. She’s had some success. “I’m helping one architect get a platinum LEED rating by using PVs and metal,” she says.

Dan Perkins, a metal roofer from Michigan’s Upper Peninsula, sees small-scale systems as an opportunity for reroofing contractors, including jobsite roll formers. “For a lot of the metal roofs you sell, you could price out a PV system at the same time.” With installation a major cost of roofing, and the laminate easily applied before installation, the homeowner could see a window of opportunity to put up both a new roof and a new power system.

That’s exactly the way it’s working for some installers, particularly those selling small systems. “About two-thirds of our customers come to us,” says Joseph Marino of DC Power, a Uni-Solar distributor in Leightonville, Calif. “One third, the roofer finds an interested customer, sells a metal roof, and gets us to come on site and laminate the materials.”

Roofers are supposed to install roofing, not PV systems, but BIPVs blur the boundaries. With small-scale systems, it may become tempting for roofers to dabble in solar design and electrical work without appropriate training — a prospect that appalls solar contractors. “PV systems need experienced designers, integrators, and electricians,” says Fischl. He’s seen projects where an architect’s aesthetic principles trumped the fundamentals of glancing the electrical system, resulting in an unworkable mess. “You can’t just put odd numbers of modules wherever you want,” says Fischl. “Architects who design without a solar consultant should be spanked.”

On the other hand, roofers need to be in the mix as well. Neither electricians nor PV installers are as well versed in waterproofing, and are more likely to rely on tubefuls of caulk to keep a roof from leaking. One Sacramento architect was shocked to find a PV laminate adhered to a metal roof with the added — and unwanted — help of screws around its perimeter. Needless to say, the assembly leaked badly. “PV guys generally don’t want to mess with roofing,” notes Perkins, “and they shouldn’t.”

There’s an ongoing battle in California as the electricians’ union is trying to assert authority over PV installations. “Everyone wants control of the work,” says Scott Womack of Powerlight. “You need electricians because these are electrical systems, and they need to do all the wiring after installation. But they aren’t set up to use cranes, offload materials, and detail roofing.” He considers his company’s product a roofing material, and has had to fight to have roofers install it.

In the meantime, the opportunity in photovoltaics keeps growing. Commercial installations remain the most promising for metal roofers, with the economies of scale making PV systems viable in many settings and with metal an accepted material in that market.

As for the residential market, California’s Local Government Commission reports that nearly 20 homebuilders in the state are now providing PV options in new subdivisions. The home models range from entry-level to luxury, and the PV systems add as little as $11,000 to the bottom line. But few if any of these builders are offering homes with metal roofs — the most sensible choice for PVs.

Which may call for a bit of education. MR