By Linda Schmid

In the last quarter of the year, predictions were made by many industry and economic experts that 2023 was going to be a let-down after the flurry of construction activity that was 2022. It’s time to check on those predictions and see if it holds up under scrutiny and find out how the rest of the year is expected to pan out.

In the Foreground

Many metal roofing insiders see positivity in the industry. Ann Iten, Director of Marketing for Westlake Royal Roofing Solutions, for one, says that the metal roofing industry grows year after year, in part due to the growing demand for products that last a long time.

Renee Ramey, Executive Director of the Metal Roofing Alliance, also comments that the residential roofing market is strong, although backlogs have softened. She reports continued growth in consumer awareness of the benefits of metal roofing.

However, both Ramey and Iten see some challenges in the market.

“The economy is, and will likely remain, the biggest challenge for everyone in roofing and construction through this year,” commented Iten. “Inflation and interest rates are both still high, and they are making it difficult and more costly for builders when sourcing financing for new construction projects of all types. These same economic conditions are also impacting owners’ abilities to pay for roof retrofits, which obviously impact the business of contractors,” she concluded.

“We are seeing a subsection of the residential market slow a bit due to the economic climate, but certainly that impact has been minor up to this point,” Ramey said.

Ben Johnston, COO of Kapitus, a provider of financing for small and medium sized businesses said, “Higher interest rates are cooling the real estate market across the country, but we continue to see strong credit demand from contractors as a shortage of affordable housing, coupled with low unemployment rates, generate demand for new housing stock.” He also sees homeowners who are locked into lower rate mortgages choosing to stay in their homes rather than selling and repurchasing in a higher rate market. These homeowners are looking to renovate existing housing stock, driving demand for contractors.”

Since spring of 2022, Johnston has seen a tightening in credit, however, which accelerated after the failures of SVB and Signature Banks. As banks become more cautious, many quality applicants, often small businesses, are unable to obtain the financing they need.

Perhaps tighter credit explains why Sean Shields of the Structural Building Components Association (SBCA), sees that single-family housing construction has returned to 2019 (pre-COVID) levels. He notes that many component manufacturers who were in a position to pivot to multi-family projects actually saw an increase early this year as near-record numbers of large projects got underway.

High-end earners who will sometimes move forward with projects regardless of the economic situation have continued to invest in real estate and home improvement.

For many, the slow start to the year is providing the opportunity to retool and retrain.

“Production equipment that has been on backorder for 12 months or more is being delivered and installed,” Shields explained. “Personnel have to be trained on these new systems, and the current conditions are favorable to getting this new capacity up and running.”

Due to the current slowdown, lumber costs have been relatively low for most grades and sizes. MSR lumber is still difficult to source in many areas of the country, though, impacting products such as floor trusses and long span roof trusses.

However, it appears that not all construction niches are equal. Rob Haddock, CEO of S-5!, says that while residential construction has taken a geographically varied hit, other sectors are doing well.

“The commercial/industrial space is still reasonably robust, especially in manufacturing and data center related construction. The agricultural marketplace is on stable ground, pardon the pun,” Haddock said.

“Obviously, the economy has dampened real property commerce because of interest rate increases, but the uncertainty of economic stability going forward has played the greatest role in dampening the construction economy,” Haddock said.

Keith Dietzen, CEO of Keymark, said that it’s a bit of a surprise how strong the post frame and roofing industries have remained while interest rates have gone from near zero to the highest in many years.”

He hasn’t seen that the Federal Reserve’s interest rate adjustments have affected business much currently. “My customers all report a very strong book of business,” he said.

On the Horizon

Tom Bowne, Chief Economist for the Freedonia Group (a division of MarketResearch.com, Inc.) has this to say: “We expect that residential construction activity will face a number of headwinds in 2023. As the Federal Reserve maintains its tighter monetary policy in an effort to keep expectations of future inflation from rising, mortgage interest rates will remain elevated, constraining housing demand. Smaller regional banks are likely to be less eager to make construction loans while these banks’ balance sheets are under increased scrutiny. That tighter lending environment will weigh on builders’ and contractors’ ability to finance projects.

Later in the year, however, there is a chance that the Federal Reserve may ease monetary policy somewhat, offering some relief for mortgage lending. The other factor that will likely provide a boost to new construction as 2023 progresses, Bowne continued, is the aforementioned lock-in effect of existing homeowners with low mortgage interest rates retaining ownership. The lack of available houses will create new home construction demands for newly formed households.

Shields says that component manufacturers as a group expect the last half of 2023 to pick up. There is concern that many projects will be started within the same time frames, thereby straining supply chains and causing volatility in the lumber and steel markets. Further, hiring and training enough help to service a spike in demand could be problematic.

Component manufacturers advise builders and developers to avoid a ‘wait and see’ attitude, according to Shields. “By the time you realize that a lot of projects are going forward, it’s likely too late to get a good place in line which can lead to many delays such as material or production capacity shortages.”

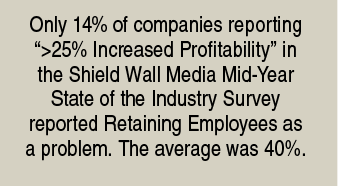

Ramey agrees that trying to hire more labor all at once to take care of a sudden upsurge in construction work would be difficult; she says that the labor issue continues to be one of the biggest challenges in the construction industry (as well as other industries).

Dietzen concurs that the labor shortage will continue to be problematic. He advises employers to automate as much as they can.

“My best advice to contractors is to automate,” Dietzen stated. One of the most effective ways to address the labor challenge is to use software systems that can automatically generate necessary information that otherwise would require many hours of toil from team members who are already more than busy.

These concerns may be inapplicable, at least in the short term however, as Johnston warns that the SVB and Signature Bank failures have made everyone more cautious and if interest rates continue to rise, participation by those paying the bills may dissipate. More likely they will continue to build and invest, but they will be looking for price concessions and better overall terms Johnston said.

Johnston’s group sees trouble ahead for the commercial market as remote work becomes a permanent fixture in American life and many long-term leases expire.

Bowne feels the outcome of that trend is uncertain. He put it this way: “Office construction is expected to see below-average activity for a few more years as businesses continue to sort out staffing arrangements (in-person vs. hybrid) and their need for space to handle their personnel.”

He expects that the non-residential construction markets in general may face a bit of a downturn similar to the residential market later this year based on the difficulty in obtaining construction financing.

“Activity in retail building construction will be dampened if consumer confidence and overall economic activity weaken during the middle part of 2023,” Bowne said. ”

However, he did offer some hope for light manufacturing. “Construction of light manufacturing facilities will continue to be aided by efforts to improve supply chains, which could induce some reshoring of manufacturing activity,” he concluded.

Over-All Advice

What should roofers do going forward?

Mike O’Hara, National Sales Manager at Levi’s Building Components sees continued price fluctuations and believes that estimating jobs will continue to challenge many roofers. He advises, “Don’t just bid on projects to keep your crew busy. Know your numbers and take the emotion out of the estimating process. Then, be all-in on projects, as the best advertising is word of mouth and repeat customers.”

Ramey said, “We anticipate the importance of environmentally friendly building materials will continue to drive the market toward products that are sustainable, offer longevity, and provide benefits in the extreme weather conditions we continue to see happening throughout the U.S. and Canada.

Iten is like-minded. She says, “We are monitoring the increased visibility around energy efficiency and total cost of ownership. We are also watching any shifts in code compliance relative to climate conditions and regions as well as insurance criteria surrounding product performance. These currently vary market to market.”

Roofers would do well to ensure that the roofing solutions they select can stand up to severe weather events that, Iten warns, are not going away.

Increased interest in energy efficiency makes a good case for Haddock’s advice. He says builders/contractors should be proactive and provide themselves a Plan B in case their usual revenue takes a dip, for example the installation of solar photovoltaic products.

Two trends that Dietzen has observed seem to bode well for the future: More and more roofing contractors are adding metal roofing to their service menu and consumer demand for barndominiums is growing.

“There is real opportunity in these markets,” Dietzen said.

Perhaps there are more good Plan B options.

A good marketing plan can go a long way to boost your business when the rain sets in.

Ramey provides this marketing advice to builders, contractors, and roofers: “Spend time fine-tuning your in-home sales efforts. Make sure you have financing options available, can provide references that speak to your work, and provide a high level of customer service. Lean on professional organizations, such as the MRA, for assistance in driving awareness in your local market, providing the information homeowners want to see, and highlighting your business quality through third party validation,” she concludes. MR

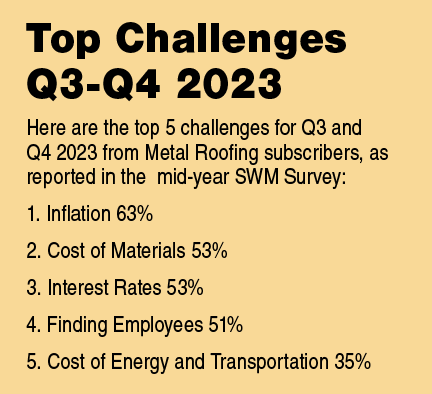

The highlighted data points are from the Shield Wall Media mid-year State of the Industry Survey. For more survey results relevant to the roofing industry, see the Construction Survey Insights published in every edition of Shield Wall Media publications.