By Linda Schmid

Shield Wall Media and METALCON conducted an industry survey that generated a lot of market information, and we are providing a few of the basics here. Watch for our new Construction Survey Insights—Annual (mailing in April) for more in-depth industry insights.

A new year is begun, and businesspeople in every industry are moving forward with great hopes that the economy will work in their favor. One might think the roofing industry is somewhat immune since everyone needs a roof, and most people are not prepared to allow the rain into their buildings to avoid the cost of repairs. However, the number of new roofs is largely dependent on the state of the economy and even reroofs may be put off for a time.

Economists have much to say about the U.S. and global economy, but we will confine ourselves to those who look specifically at the construction industry.

The Economists

Economist Anirban Basu regularly reviews the state of the economy and its likely impact on the construction industry. He has provided a mixed outlook for 2024.

“The upcoming year will present varied challenges and opportunities for contractors,” Basu said. “Contractors focusing on public works are poised for a successful year thanks to increased funding from infrastructure legislation, while those working on residential properties will likely see a shore up of projects due to a tough real estate market.” In other words, with high real estate prices and lower supply than demand, residential construction isn’t likely to slow down. Further, Basu sees growth opportunities in mega-projects across the country as many manufacturers reshore supply chains. These projects will call for more employees in an industry that already offers more job opportunities than skilled/quality workers to take them.

When considering what situations may negatively affect peoples’ plans to build, Basu advises remembering these: high consumer debt, geopolitical uncertainty, stricter credit conditions, and the government’s increasing debt. However, he believes that the bond market indicates a likely decline in interest rates by mid year. If this occurs, it could mean greater project financing and backlog generation.

Ken Simonson, Chief Economist of the Associated General Contractors of America, said that after a torrid third quarter in 2023, slower growth is expected going into 2024. Overall, he believes that unemployment will remain low.

“Some industries will cut head count, but most people who want jobs will find them quickly,” Simonson said. “Conversely, employers in expanding industries such as construction, will continue to have trouble filling positions,” he said, “and will have steadily increasing wage bills for new workers (when they can find them) and overtime or bonuses.”

Simonson said that while most supply chain issues have been cleared up, there remain a few holdouts, such as electrical equipment and it looks like these will likely remain problems throughout 2024. He expects these supply challenges along with labor shortages will stretch project completion times.

Specific niches that Simonson expects to do well in 2024 are data centers and manufacturing plants followed by infrastructure and renewable energy projects.

The Construction Industry Survey, aka CIS

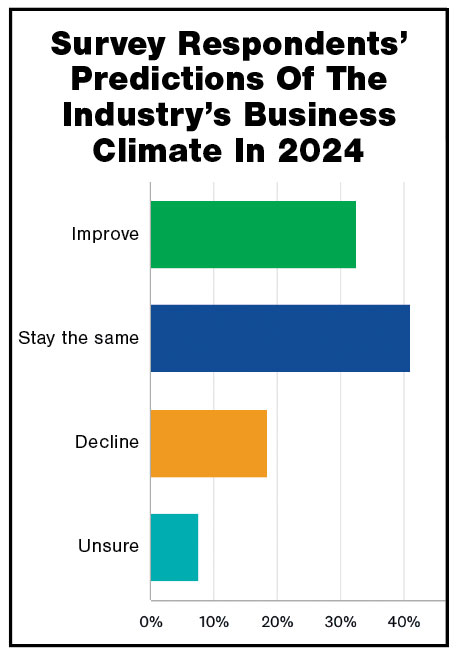

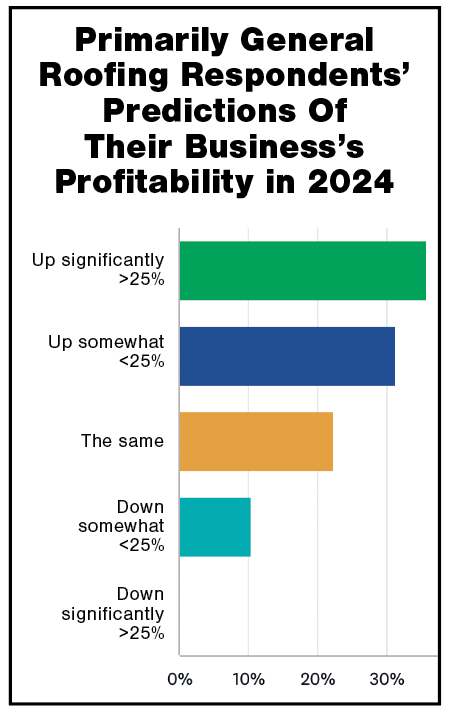

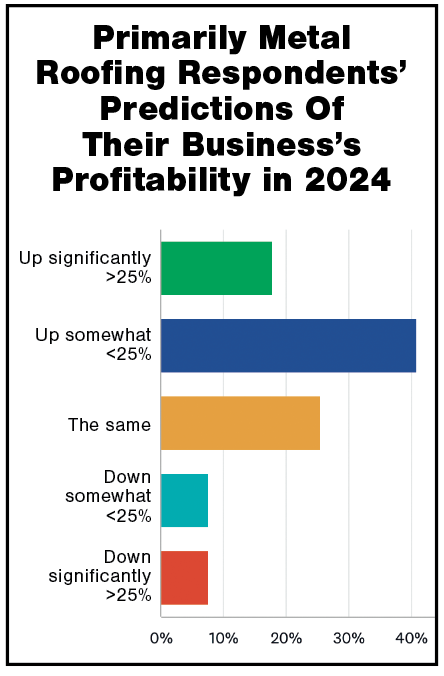

A preliminary look at a few of the industry professionals’ expectations pulled from Shield Wall Media’s 2024 edition of the annual survey are shown in the bar graphs.

Nearly 75% believe the business climate will be the same or better than last year. When you break respondents into groups based on their primary market, metal roofing or other roofing, the metal roofing market shows less confidence in their profitability in 2024. What do metal roofing industry insiders say about this?

Industry Insiders

Everything looks rosy from where Drexel Metals sits. Brian McLaughlin, National Sales Manager said, “Finally, the flow of projects and purchase orders are where they were pre-pandemic. The supply chain rebounded, and pricing stabilized. Overall, 2023 has been a great year for supporting our customers’ businesses,” he added.

McLaughlin continued, “We see continuing opportunity. The metal roofing industry is interesting as no manufacturer has market share. Instead, it is a fragmented regional industry with many players. And while some are viewing 2024 as bearish due to rising interest rates (there may be some truth to that), activity in bid work and design work remains strong.”

Proof of their positive outlook is Drexel’s introduction of a new product line of insulation for ceilings and walls, working toward a full assembly solution for customers.

Keith Dietzen, SmartBuild CEO said, “I continue to be amazed at the strength of demand for both post frame and all metal buildings. Honestly, the biggest challenge my company faces in growing our customer base is how busy our prospects are. I keep waiting for the economy and the demand for these buildings to take a big hit because of the Fed’s policies, but continue to be surprised.”

Rob Haddock, S-5!, has seen some industry slowing, but he points out that is not necessarily bad.

“We have definitely seen a slowing in the year-over-year (YoY) growth rate, but not a backwards slide YoY,” Haddock said. “This was predictable as the extreme rate of growth in construction, generally speaking, was just not sustainable or healthy. 2023 felt like someone hit a “pause button.” That is not surprising with interest rate hikes and economic uncertainty proliferating in news media. In some ways, this is a blessing because the growth in our business was nearing break-neck speed.”

Haddock continued, “Most of our end uses are in the commercial and industrial sectors and involve life-safety products, such as fall protection and other essential applications, so we are comfortably situated with a backlog and strong pipeline and expect to see double-digit growth in 2024.”

Renee Ramey, MRA Executive Director, is similarly minded. She remarked that 2023 was a solid year for residential metal roofing. Supply chains re-stabilizing was very helpful to that end.

“Although rising interest rates have caused some homeowners to be slightly more conservative when it comes to investing in home improvement projects, Ramey said, “the need for more resilient, longer lasting building materials has continued to drive demand.”

Ramey continued, “The residential metal roofing industry in both the U.S. and in Canada are in very favorable positions. Our latest market share research (2022 Dodge Report) indicates that demand for metal roofing has jumped to a record high, up by six percentage points in just three years.”

Ramey added that the MRA anticipates that will continue, “so long as the industry maintains an aggressive effort to educate, inform, and promote metal roofing’s many advantages among homeowners.”

Insiders on Interest Rates, Inflation and Debt

Everyone is talking about interest rates; will they continue to rise? Will they depress the market?

Dietzen said, “I believe the Fed will maintain high interest rates until it sees inflation return to the 2% neighborhood. We should see sluggish growth or recession until that happens.”

He continued, “There’s no doubt there is a shortage of housing stock that fuels ongoing demand, though the rise of the 30-year mortgage rate from 3% to 8% SHOULD have a negative impact in 2024, but I continue to be surprised at the resilience of the market.”

Ramey said, “All renovation and remodeling categories may be impacted by rising interest rates, ongoing inflation and global instability which can cause spending on things such as home improvements to slow. But the fact is the inventory of housing in the U.S. and Canada continues to age, and with climate extremes getting fiercer, the MRA believes that will continue to drive demand, despite the potential for higher rates and inflation.”

Haddock quipped that his crystal ball is busted, but he went on to say, “people gripe about high interest rates. Interest rates are finally healthy again. It discourages reckless borrowing. We have seen plenty of that. I remember during the Carter Administration when CD rates were 21% and mortgage rates at 11-14%, so 7% is not ‘high.’ I am certainly concerned that Joe Q. Public bases all buying decisions on what the monthly cost is, and lives paycheck to paycheck. That is short-sighted and self-destructive but seems to be the norm. That may be my biggest concern. Debt is not anyone’s friend — including our nation!”

The Labor Shortage and Other Challenges

McLaughlin believes the biggest challenges in 2024 will be in predicting market uncertainty and in dealing with the consequences of the ongoing skilled labor shortage. He is also keeping an eye on the cost of raw steel and aluminum as possible fallout from the Fall 2023 UAW labor strike. Our insiders, like the economists, all agree that the labor shortage is not going away any time soon, though some companies appear to be harder hit than others.

Haddock said, “For the S-5! organization, it is not so bad. I think people are attracted to our company culture. Our compensation packages may not be the ‘best,’ but are equal to or better than most, and our culture as an organization is … well, just different. We have a few who leave and many who feel ‘at home’ at S-5!”

Dietzen said, “We see the more progressive of our customers undertake efforts that include internal training programs and aggressive intern programs to attract, nurture and educate a capable workforce. We do our part by automating the demanding process of doing accurate takeoffs and generating documents that help guide field construction.”

In conclusion, there are a few things that companies can do to minimize the labor shortage’s impact on their business. Automating can help in many situations, ensuring that your company culture is welcoming and supportive while offering competitive benefits, and working with local institutions to offer internships or events to encourage interest in your company. MR