We have closed out our annual survey and are working on the CSI-Annual that will mail in April. Our efforts to improve our data collection seem to be working. We roughly doubled the total number of respondents from 2022 to 2023.

Our strong areas, like post-frame, remained constant, but we gained a significant number of responses in General Roofing, Metal Building and Wood Framed (Stick Built) construction. With the roll out of Metal Builder Magazine, the gain in “Metal Building” makes sense. The gains in General Roofing and Wood Framed construction should help act as a baseline or control group to measure against the specific markets we cover.

One of the interesting aspects comparing year over year are the changes in responses, hot markets, business climates and concerns. Going through the comparison from 2022 to 2023, this is what caught my attention.

Market Predictions

What Market Segments of construction do you build for?

No areas increased significantly. Agricultural, Commercial and Industrial all decreased as a percentage of respondents. Agricultural from 40% to 28%. Commercial from 67% to 30%. Industrial from 44% to 19%.

When combined with results from the question “Overall, across the industry will residential construction increase or decrease in 2024 to 2023?” the obvious assumption is the change in products is in response, preparative or reactive, to the view of residential construction. In 2022, 47% predicted the market would decrease and 32% predicted the market would the same. In 2023, 37% predicted the market would increase and 47% predicted it would stay the same. The percentage predicting an increase grew by 16%, while the percentage predicting a decrease dropped by 31%.

The market predictions for Agricultural, Commercial and Industrial remained unchanged. This seems to indicate a shift in direction to take advantage of an increase in residential construction.

This is consistent with the level of concern regarding interest rates and inflation. In 2022, 58% of respondents listed Inflation as a major concern. In 2023 that percentage dropped to 27%. Inflation followed a similar path. In 2022, 67% listed it as a major concern and in 2023 that number decreased to 34%.

Expansion Plans

In 2022, 18% had immediate expansion plans and 50% had future plans. In 2023, 28% had immediate plans and 29% had plans farther in the future.

The areas for expansion remained the same with adding personnel (both construction and support) and new products or building types leading the way.

The one interesting drop was in trucks. In 2022, 24% of respondents planned on adding trucks. In 2023 that number dropped to 14%.

Financial Outlook

The predictions of gross sales remained consistent. Units sold remained consistent as well.

Profitability remained consistent. The only significant change was an increase of approximately 7% predicting their profitability would increase by more than 25% in 2024.

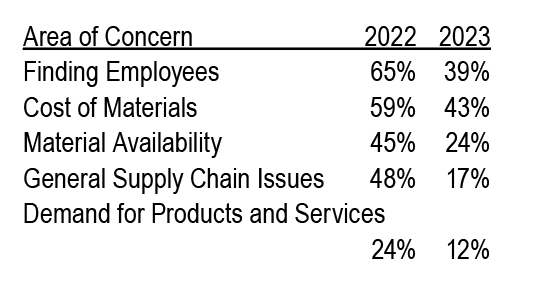

Concerns for 2024

One bright spot is the level of concern across the industry seems to have generally decreased. The challenges still remain but respondents seem less concerned.

Summary

Generally concerning issues seem down. Residential construction is expected to remain strong enough builders are shifting toward that market. Projections for gross sales, units sold and profitability remain stable. Which is extremely positive considering the industry is coming off of some record years.

The CSI-Annual will mail in April and should provide additional insight into the above topics and much more. We will be able to isolate regions, building types and specific market niches and examine our data and combine that information with input from industry experts and economists. The CSI-Annual is free to all subscribers to Shield Wall Media publications. MR