By Metal Roofing Staff

Upon exiting a business that has taken a lifetime to build, it’s disappointing to turn over a large portion of its value to the IRS. Fortunately, if a business meets certain criteria, an employee stock ownership plan (ESOP) can provide the exiting owner with attractive benefits. It can also provide the new owners (employees) with benefits that make the business more successful. Here, we’ll take a look at what an ESOP is, the benefits of the plan, and what makes a company a suitable candidate for an ESOP.

The ESOP, as defined in the IRS code, is a structure that allows employers to share ownership in a company with employees. The ESOP can purchase any percentage of the business.

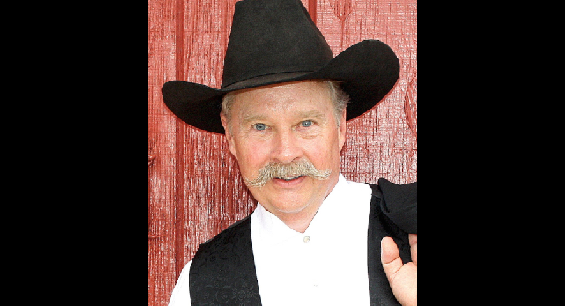

Scott Eichler, an investment advisor with Standing Oak Advisors and author of Don’t Play Chicken with Your Nest Egg, explains the benefits of opting for an ESOP plan upon exiting a business: “If a business owner chooses an ESOP, the IRS offers attractive benefits. For example, it allows the business owner, when selling the business internally to employees, to defer taxation of the sale of the business.”

If the business owner’s intention is to sell the business and invest the money earned from that sale, the immediate benefit is the tax deferral on the sale. “There’s more to the sale of a business than how much you sell the business for,” Eichler continues. “The more important question is: How much do you get to keep after the sale of the business? There’s a time value of money. If you lose a big chunk [of the sale amount] to taxes, the time value of money is greatly diminished; you don’t have as much to build a retirement income.”

Rather than paying the taxes on the earnings from the sale, when the business is sold to an ESOP, the money is invested, it grows, and is reinvested. Taxes are paid on the income from the investments. By deferring tax payments, it gives the former business owner the opportunity to build wealth faster and the chance to take a bigger income throughout retirement.

There are additional benefits, too. “ESOP is conjoined with a lot of agreement pieces and protections in case something happens,” Eichler adds. “This is making sure that 1) You get bought out, and 2) your family is taken care of in case something happens to you.”

Benefits for Employee-Owners

Often, a construction business is all about relationships, so a lot of business owners have a hard time selling their business to a third party. “You have to find someone with synergy who knows the existing clients and have a reasonable degree of trust.” Just because you’re doing a certain level of business each year doesn’t mean that will continue after the sale. Most companies don’t have proprietary construction techniques — they have relationships. It’s those relationships that are the foundation on which a business’s ongoing success is built. Being able to transfer those relationships takes time and is not easy. “It’s an easier transition if you can sell to an employee who has the same business relationships that you do.”

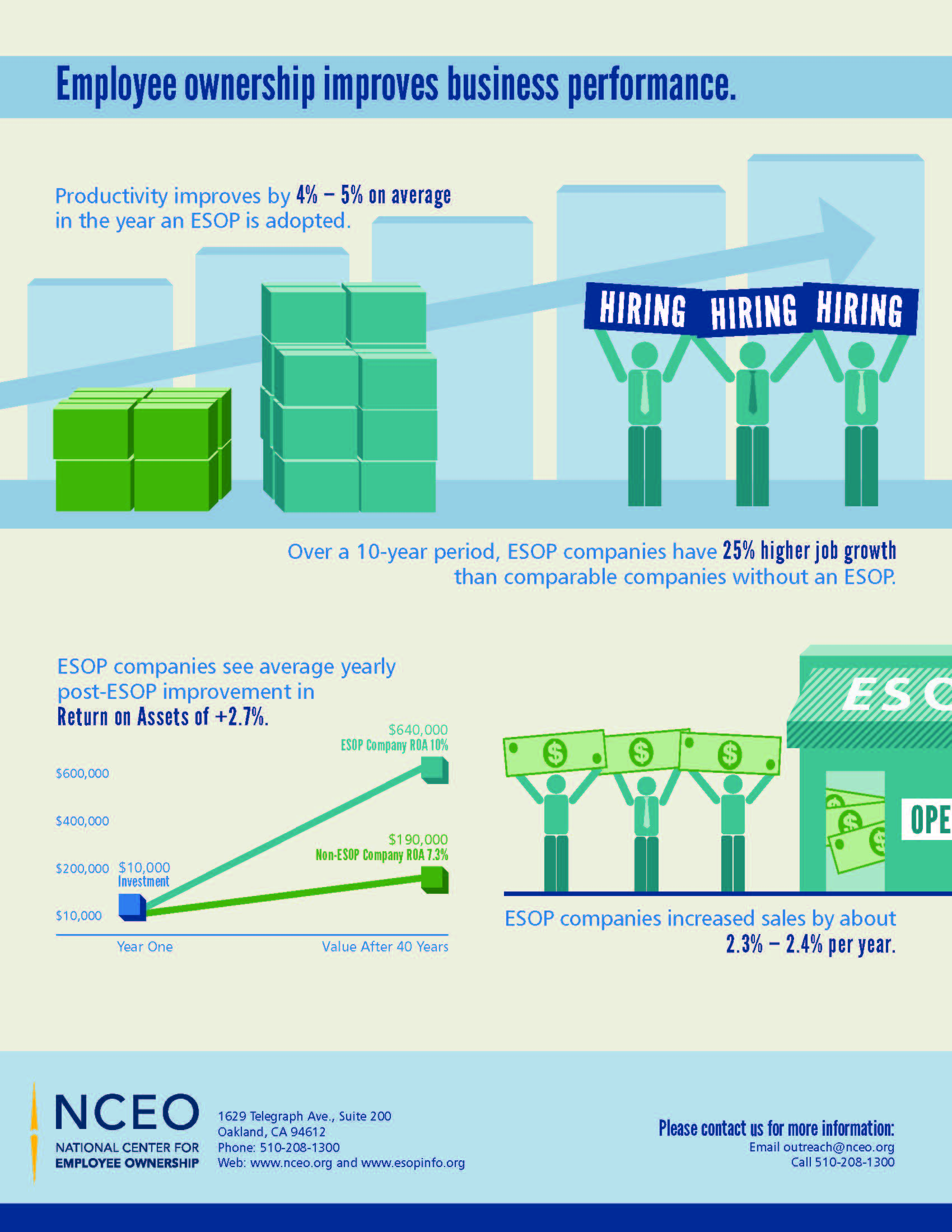

Once ownership of a company is transferred to an ESOP, employees now working for themselves. If employee-owners understand how the company makes money, and their individual role in making that happen, they have a real buy-in in the success of the company. According to the NCEO, “Companies that have these high-involvement, idea-generating cultures, generate an incremental 6% to 11% added growth per year over what their prior performance relative to their industries would have predicted.” Therefore, the ESOP-owned company is more successful and the employee-owners reap more rewards.*

Is ESOP an Option?

First and foremost, the corporate structure must be considered. According to the IRS, for companies to be ESOP eligible, they must be C corporations, S corporations, or LLCs taxed as a C or S corporation.

Even if a company has one of these structures, there are situations when an ESOP is not a feasible option. Companies must have sufficient profitability to pay the added expense of buying out one or more owners. Eichler said if the company isn’t generating at least $1.5 million in EBITDA, it’s not a viable option.

Because of the substantial setup costs, ESOPs generally don’t work for companies with fewer than 15-20 employees. According to the National Center for Employee Ownership (nceo.org), ESOPs generally cost between $100,000 and $300,000 to set up. Fees include feasibility studies, plan documentation, valuation, trustee fees if using an outside trustee, plus any corporate legal fees and personal financial advisor fees for the seller. The cost can increase in larger and complex deals.

Another thing to consider is the leadership structure. There’s a good chance the seller(s) holds a key corporate role, so the business must have a management team in place. “There needs to be a group of two or three people that can do sales and operations, and essentially manage the business the way the owner does,” explains Eichler. “They need the ability to manage people.”

Planning for Success

An ESOP requires a lot of planning. “If you’re going to retire, and your plan is to sell your business in 20 years, you don’t have to do anything right now,” Eichler says. “But it’s a good thing to start the discussion. The more time you give a financial planner, the better. Don’t put it off. Have a discussion and decide at a very basic level if it’s an option for you.” A 30-minute conversation with a financial planner “can be a really good use of 30 minutes.”

He says an ESOP can be achieved in five years, but there is little room for error. “This is not a quick-buck strategy,” he says. “This is time, thought, and work.”

Eicher notes there are six overview steps for setting up an ESOP:

Step 1: Make sure all the owners are on board or at least open to listening. “Someone who is very resistant in the group really puts a fly in the ointment,” Eichler says. “You have to make sure everyone is willing to discuss ESOP as an option and the waters are smooth before jumping into the pond.”

Step 2: Feasibility study. “I recommend creating a feasibility study for the current owner. It can be done in-house if you have a quasi-CFO, CFO, or controller getting up to the CFO level. But the recommendation I make to a lot of my contractors (ones who have 50-60 employees) is that they find a firm that that’s what they do.” That firm can, with impartiality, compare and contrast different options (i.e. ESOP, private equity, merger & acquisition) to determine the best exit strategy for the owner. “As much as ESOP is a great tool, it’s a tool so it has to be applied precisely in the right place.”

Step 3: Valuation of company stock. “Whoever does the valuation for feasibility should not do the valuation for company stock,” Eichler advises. “A trustee of the ESOP should value the company stock because they’re doing it on behalf of the future ESOP owners.”

Step 4: Attorneys draft a plan. It’s up to the attorneys to draft a plan between the current owner and future owners. “No one but an attorney who has experience drafting ESOP plans should do it,” he cautions. “If something goes wrong, the attorney’s Errors & Omissions insurance plan would cover it.”

Step 5: Fund the plan. An ESOP can be funded through traditional banks, loans for the purpose of establishing an ESOP, private parties, or even income from the company itself. “When you get to this step, you’ve already decided how to fund the plan – it’s just a matter of doing it,” he says. “After the first five steps, you have an ESOP.”

Step 6: Maintain the plan. This step is the most important. “Maintaining the plan includes oversight, compliance with the IRS and reporting to the IRS. You have to do this to maintain your preferential treatment as an ESOP.”

What Comes Next?

“I always encourage my initial owners (selling owners) to make sure they’ve got a plan for what to do with the money they receive from their business. You want to design something,” he advises. “If you’re going to retire, what are you going to do next? You want to make sure you’ve got something going for your next phase of life.

“I’ve seen people who don’t have a plan,” he continues. “Their health degrades quickly and they pass away sooner than they should. And a lot of people end up not doing fun things because they’re worried about running out of money. Have a plan.”

Conclusion

ESOP is a very structured yet flexible system to transfer wealth with a minimal tax effect. Over the last 20 years, they’ve become much more known in the financial industry. However, Eichler estimates only about 11% of contractors use ESOPs. You may ask, “If ESOP has so many benefits, why isn’t it used more by companies that fit the profile?” Eichler explains: “ESOP requires some forethought. Valuation metrics and factors need to be looked at to make sure this tool applies. If something is a little more difficult, it gets used a little less.” MR

*Preparing the employee-owners shouldn’t be overlooked. “You have a whole bunch of employees becoming owners and they’re not really aware of how to do that. You want to make sure they’re well prepared for this chapter of their life,” advises Scott Eichler, investment advisor with Standing Oak Advisors.