By Rick Zand, New Tech Machinery

As the demand for sustainable building materials increases, the metal construction industry is perfectly situated to provide eco-friendly cool roofs and siding that may qualify consumers for tax rebates and LEED credits. While metal roofs cost roughly two to three times more than roofs with asphalt shingles, rebates and credits can help offset the higher price.

Why Is Metal Eco-Friendly?

Metal roofs are comprised of at least 25% recycled material and can be recycled 100% an infinite number of times. They keep indoor temperatures cooler, last longer, and require little maintenance. As discussed in a blog post [https://bit.ly/3SeDnZz] on fire resistance, they’re also preferred in fire-prone areas.

On the other hand, according to the National Association of Homebuilders Research Center [www.nahb.org], 10 million tons of asphalt shingles are dumped in landfills every year. Asphalt’s carbon footprint is excessive, not only in the manufacturing of this petroleum product but even in use; hot days bring out the carbon emissions from asphalt due to solar radiation.

While they are working on recycling asphalt shingles, the goal is set at only 1% by 2030. Therefore, the shingles will continue to pile up in landfills at nearly the same rate for the foreseeable future.

LEED Standards

The U.S. Green Building Council (USGBC), the governing body behind Leadership in Energy and Environmental Design (LEED) certifications, outlines the framework for LEED standards. Their goal is to encourage energy-efficient buildings that offer environmental, health, and societal benefits.

LEED v5 is the latest draft; however, it is still in progress as stakeholders provide feedback. In the interim, refer to LEED v4.1. for checking eligibility of LEED points for metal roofing and siding.

Contribution To LEED Points

Check the LEED rating points for metal roofing here. LEED points can also apply to metal siding, like heat island reduction, based on the same criteria.

LEED recognizes when a building or community uses materials to maximize energy efficiency and sustainability. LEED structures may qualify for rebates and other incentives and can increase property value.

What’s a “Heat Island”?

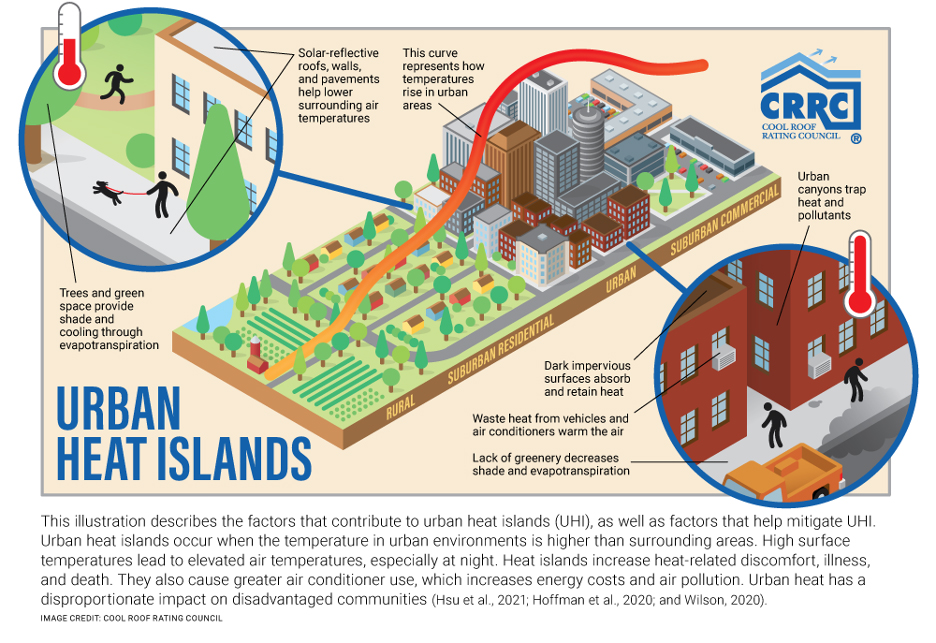

We’ve all seen images of emergency workers opening fire hydrants in inner cities so that children can cool off under the spray of water on hot summer days. The heat radiating from the streets, along with the trapped air and a lack of vegetation and green spaces, all contribute to the increase in temperature. These hot spots have become known as heat islands.

According to the Green Building Alliance (GBA; www.gba.org), heat islands occur in densely populated urban areas. Compared to surrounding areas, temperatures can rise to 5.4 degrees Fahrenheit during the day and up to 22 degrees Fahrenheit in the evenings. Indoors, the temperature also increases, as 90% of roofs in the U.S. are heat-absorbing, and most home heat enters through the roof.

Cool Roofs

Cool roofs like standing seam metal address this phenomenon due to their reflectivity, providing a cooler indoor environment. This contrasts with heat-absorbing roofing materials like asphalt shingles, which do little to reflect solar radiation and increase energy consumption. GBA reports that cool metal roofs reflect as much as 70% of solar energy away from the building, whereas materials like asphalt shingles reflect only 5% to 30% of the sun’s energy, depending on the color of the shingles.

Lowering HVAC energy usage will lessen the carbon footprint by reducing the burning of fossil fuels to generate power. This means less greenhouse gas emissions and improved air quality. GBA reports that 40% less energy is used with a cool roof.

Solar Reflectance (SR), Thermal Emittance (TE), and Solar Reflective Index (SRI)

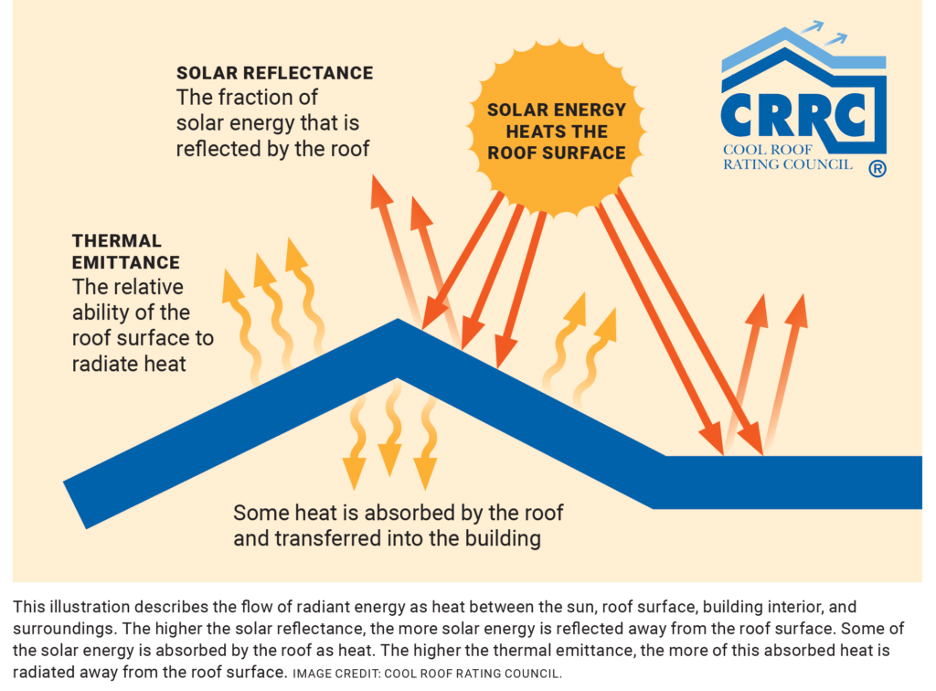

Solar reflectance relates to how much solar energy is reflected off the roof’s surface, measured on a decimal scale between 0 and 1, where 0 is the truest black, and 1 is the truest white.

For LEED v4, solar reflectance for a low-sloped roof (≤ 2:12) is greater than or equal to an initial value of 0.65. After three years, its solar reflectance is measured as greater than or equal to 0.50.

For a steep-sloped roof (>2:12), the initial solar reflectance should be greater than or equal to 0.25 and, after three years, greater than or equal to 0.15.

Heat islands occur in densely populated urban areas.

Thermal Emittance (TE)

A material’s thermal emittance will determine how much heat it will radiate. Any surface exposed to radiant energy will increase in temperature until it reaches a point where it gives off as much heat as it receives, known as thermal equilibrium.

A high emittance surface will reach thermal equilibrium at a lower temperature. A low emittance surface will not radiate the heat as quickly. So, the higher a roof’s thermal emittance, the less heat is retained within the roof, and the less heat is absorbed into the building.

Like solar reflectance, thermal emittance is measured on a scale from 0% to 1%.

Solar Reflective Index (SRI)

The SRI combines SR and TE to indicate a roof’s overall ability to return solar energy to the atmosphere. When placed under the same conditions, roofing surfaces with a higher SRI will remain cooler than surfaces with a lower SRI. In other words, a metal roof should measure a high SRI, while a conventional roof will rate at a low SRI.

SRI is calculated using the SR and TE, measured in values between 0 and 100. The SRO combines SR and TE into one number used to rate the material’s LEED performance.

LEED requires roofing materials to have an SRI of 29 or more for steep-slope roofs and more than 78 on low-slope roofs. Manufacturers should be able to provide documentation. If not, you can have SRI testing performed in a lab [https://coolroofs.org/programs/roof-rating-program].

LEED Credit Benefits

• Tax incentives—Many states offer programs to encourage energy efficiency through LEED.

• Increasing energy efficiency is good for the environment and saves your customers money on energy bills. Since metal roofs keep buildings cooler in the summer, less demand on the HVAC system means more savings.

• Increases property value — A metal roof can increase a home’s value by up to 6%. For example, on a $500,000 home, that’s a $30,000 increase in value over a house with an asphalt shingle roof. A significant return on investment for your customers.

Tax Credits and Rebates

According to the National Association of Homebuilders, contractors who can show they can build homes that can withstand the impact of environmental hazards like strong winds and wildfires have a competitive advantage, as living in an area with these hazards can increase insurance rates significantly and leave the property owner at risk of loss. Builders and contractors can use this risk as a selling point for the benefits of metal when it comes to storms, fires, and natural disasters.

This is especially true in the West, where drought and severe heat have led to an increase in wildfires. As a result, home and business owners have become more conscious of the materials used to construct their buildings. In some high-hazard areas, insurance companies will refuse to cover homes and structures made of flammable materials such as wood siding and shingle roofs.

Further, installing environmentally friendly materials like metal roofs and siding can generate other tax credits and benefits.

As part of the Inflation Reduction Act, the Biden-Harris administration allocated nearly $9 billion to states and tribes for homeowners who make their homes more energy efficient. Grants to states and local governments that apply to efforts that meet the 2021 International Energy Conservation Code (IECC) can benefit builders and consumers. Also, home energy rebates and tax credits may be available if the home is improving its efficiency.

HOMES Rebate Program: Provides over $4 billion to states for homeowners who renovate their homes to be more energy efficient. Eligible homeowners can receive $4,000 to $8,000 in rebates.

Metal Roof Federal Tax Credit: This tax credit offers homeowners with metal roofs installed a 10% credit on the cost of the metal roof up to $500.

Requirements:

• The metal roof must be installed on the homeowner’s primary residence.

• The metal roof must meet certain energy efficiency standards that meet or exceed requirements for reflectance and emissivity.

• The roof must be installed within the tax year for which the homeowner is claiming credit.

• The homeowner must have all proper documentation for the roof, including the manufacturer’s certification statement or testing results.

• The tax credit comes with certain limitations, so homeowners should consult with a tax professional to determine their eligibility and how much they can claim.

To receive the credit, complete IRS form 5695. Homeowners will need documentation. Then, they can add this to their tax return for credit.

Keep in mind that the credit only applies to certain types of metal roofs that meet the energy requirements. Shingle, tile, ceramic, and many other types of roofs are not eligible for the tax credit. MR

NOTE: This article is strictly informational. Be clear with your clients that while you can talk to them about tax incentives and rebates, you cannot make guarantees or give financial advice. They need to consult with their financial advisor or tax specialist for advice specific to their situation.